True wealth comes from learning the value of "enough"

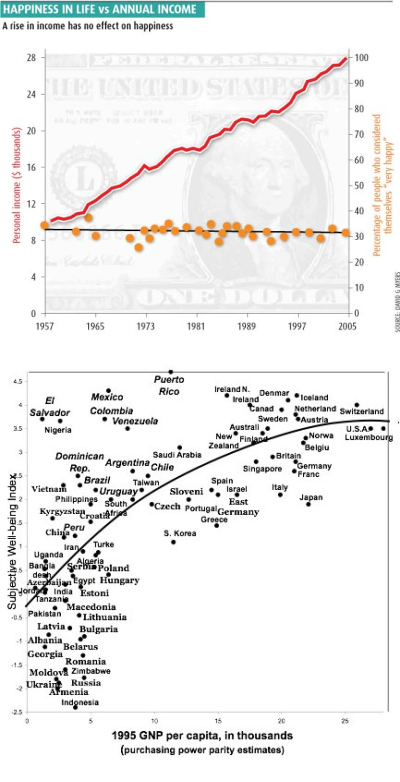

Many

people chase the almighty dollar because they think having more

money will make them happy. But scads of scientific studies have

shown that people with more money are no happier than those with less

(once you pass over the lowest income hurdle of having food and

shelter, that is.)

Many

people chase the almighty dollar because they think having more

money will make them happy. But scads of scientific studies have

shown that people with more money are no happier than those with less

(once you pass over the lowest income hurdle of having food and

shelter, that is.)

In fact, affluence is a relative thing --- if

you hang out with folks who barely have two pennies to rub together and

you've got two nickels, you're going to feel rich. On the other

hand, if you hang out with someone who owns his own island, you're

going to feel poor despite having a huge house and a fancy car and your

own yacht.

The American dream tells

us that we'll really be happy once we've got

all of the modern conveniences that our neighbors have, but most of the

time

when you try to have it all, you just end up with lots of little bits

of nothing. You work so many hours that you barely enjoy your

McMansion, then you're putting in overtime to save for your

kids' college education and end up feeling like you're living with

strangers. How can you break out of the cycle of measuring

yourself against your neighbors and always wanting more?

The trick is to learn

the value of "enough" by recalibrating your financial sensors.

Throw away your

television and stop listening to commercial radio --- those ads that

you think you can ignore are really seeping into your dreams.

Even movies are nefarious --- have you noticed that most movie

characters have a fancy new car and all of the modern

conveniences? By watching, you're telling your psyche that these

movie stars are who you want to measure yourself by.

If you can disentangle

yourself from the mainstream media, chances are you'll stop wanting so

much stuff. Mark and I are barely middle class by most people's

standards, but when people ask me what I want that I don't have, I

honestly can't think of anything. (Except more mulch, of

course...) By learning that "enough" for us costs very little

money, we were able to quit our

jobs and devote most

of our time to the things we really enjoy.

I think that people who

achieve financial independence and

true happiness are marked by only one thing --- they can figure out

when they have enough. Are you always in search of the next

raise, a new car, or a fancy gadget to make you happy? Or do you

realize that the things you really value in life are time with friends

and family, time to explore your hobbies, and time to change the

world? If the latter, then you have learned the value of enough

and can skip most of the Financial Integrity process --- you're there!

| This post is part of our Your Money or Your Life lunchtime series.

Read all of the entries: |

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

http://en.wikipedia.org/wiki/Middle_class_squeeze

More or less what I was getting at... I'd argue that our purchasing power hasn't necessarily gone up when one considers the cost of education, housing, and health care.

But how much of that is also relative? I posted over on my wetknee blog today about how annual housing cost for the American family is currently over $16,000. That's in large part because most Americans think it's their right to own their own home, and not just any home but a huge house --- the square footage of American homes has tripled in the last half century. If we were willing to live in just 250 square feet per person (the average in 1950), could we do that on less money than people could in 1950? I don't know the answer, but I suspect we might be able to.

Education has seen a similar trend. My understanding is that people didn't used to go to college as a matter of course just a few decades ago. Now, everyone thinks they have to have an ivy league education. Now, I adored my ivy league education, but in retrospect, I'm not sure it was worth the money I paid for it.

(I don't know anything about insurance costs over time... )

)

I guess my argument is that our standards for what constitutes the middle class have risen, which is why we feel a middle class squeeze. The current middle class is more like the previous upper class. Couldn't we live a little bit lower on the hog and still be middle class, if people who lived that way fifty years ago were perfectly content as the middle class?

(I wish I could cite sources here, but these are vague memories from blogs I've read and NPR stories I've heard... )

)

I call this problem the "I'll be happy when..." syndrome.

So many people are unhappy with where they're at, but have this idea that if they just had that one more thing, they'd be completely content. It's "I'll be happy when I get a boyfriend", or "I'll be happy when I get that sports car", or "I'll be happy when I get that job". They think getting this one more thing is going to solve all the problems in their life. And that's why so many people will take on debt up to their eyeballs to buy that "one more thing".

And the weird part is, whenever they do get that thing they're yearning for, they're no happier and it's immediately replaced with yearning for the next "one more thing". Despite a lifetime of yearning, disappointment, and new yearning, they never realise that they're just repeating the same old unsatisfying pattern over and over again.

Of course, advertisers pander to this behaviour, and popular culture (TV shows, movies, magazines, music, career advisors, etc) continually reinforces it.

I think the simplest way to break free is to just stop watching TV and reading magazines. It also helps to hang around with people who earn less than you but share your attitudes and interests.