Property taxes and homesteading

I think property taxes

are one of the most-overlooked items that should be considered before

buying new land. I read all the time about homesteaders who settle in

wealthy areas and end up paying a thousand bucks or more per month in

property taxes. If quitting your job is on your homesteading agenda,

that kind of tax burden will make it exceedingly difficult to simplify

your life enough to become self-sufficient financially.

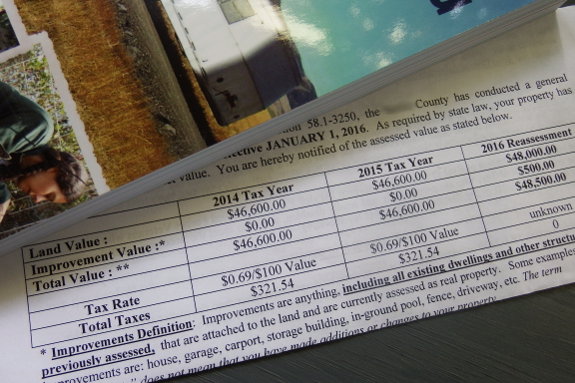

I have to admit I didn't

think about property taxes when I bought our land either. Luckily, I

couldn't afford much, and ugly-duckling properties with junked singlewides

on them command very little value on the open market. Which is a good

thing! It means that even after our most recent tax reassessment, our

property taxes are likely to stay below $35 per month. Now that's a tax

burden we can afford.

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

As long as there are property taxes, you never really own your land, but are only renting it from the govt. And then there's the eminent domain policy of the current candidate favored by the trailer trash crowd.

You also have to plan ahead: a friend of mine bought a lot in a rural area 90 miles outside of Chicago 20 yrs ago. Thanks to urban sprawl, that area is now a growing suburban community needing to build new schools, etc. He could no longer afford to build & retire there thanks to the burden of increasing taxes.

NaYan --- Our county does a tax break for retired and/or disabled people as well. Definitely worth looking into for folks who fit either category.

Doc --- Thinking ahead to how your property taxes will change over time is very smart, but I'd say hard to do! I guess if you're relatively close to a big city, you can assume the town will likely swallow you up in your lifetime. Hopefully we'll be spared....